Did you know that most insurance claims in the U.S. are grossly underpaid? Even worse, many legitimate roof repair claims are completely denied. This doesn’t necessarily mean that your insurance company is out to cheat you from getting your roof repair paid. But when it comes to spotting roof damage and filing homeowner’s insurance claims, it’s important to involve seasoned roofing pros. We’ve spent a lot more time on rooftops than insurance adjusters, and we understand the entire process of working with insurance companies on roofing repair and replacement claims. So, next let’s talk about how to file an insurance claim for your roof.

How to File an Insurance Claim for your Roof

Dealing with insurance companies can be extremely confusing and frustrating – and that’s why the Driftwood Builders Roofing team’s experience in insurance matters can be extremely helpful. Our claims specialists know what to look for regarding roof damage and may be able to see problems that the adjuster doesn’t. We have worked harmoniously with many insurance adjusters over our many years in business.

Have your Insurance Adjuster and Roofer Evaluate your Damaged Roof Together

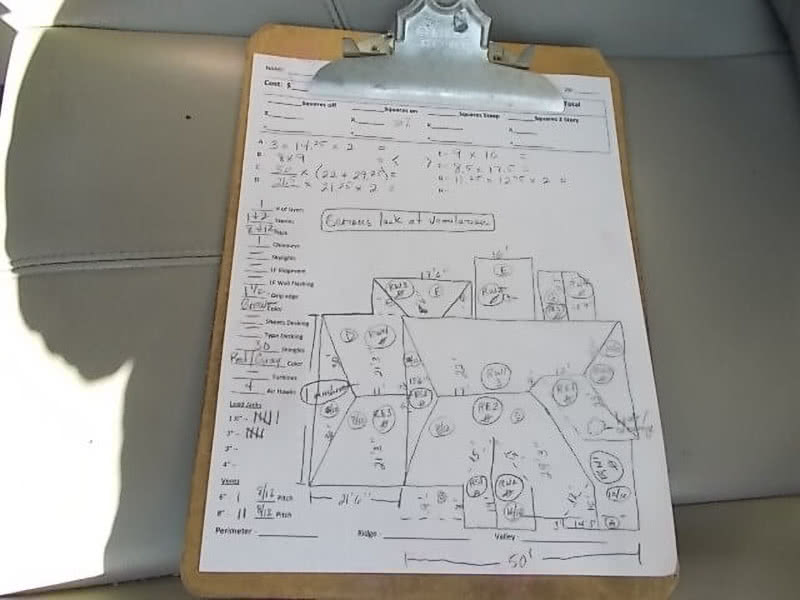

If you believe you might have roofing damage caused by a bad storm, Driftwood Builders Roofing will provide a FREE, no obligation inspection. If any storm damage is found, you’ll be notified by our inspector so you can schedule an insurance adjuster visit. Your Driftwood Builders inspector will meet with your insurance adjuster to discuss the damage we found and help you receive a fair and equitable claim.

Most insurance companies try to limit the dollar amount they intend to pay on their initial replacement cost estimate. Our team of roofers will work (negotiate) with your insurance carrier to make sure they are paying the right amount to help you get the high-quality roof you need and deserve.

We Help Even if the Adjuster has Made a Decision on your Claim

It is best if we can represent you with your homeowner’s insurance company during the initial inspection of your damaged roof. However, if your claim was rejected and you think you have a legitimate claim, let us take a look at the damage. If we do not agree with the adjuster’s investigation, we will recommend a second inspection. Rarely will insurance companies refuse a second roofing inspection, but the claim handler may ask for photos of the damage. We would be happy to take the photos for you.

Was your Roof Damaged by a Storm?

Our roofing repair team offers:

- FREE, no-obligation inspection

- Meeting with your insurance adjuster

- Insurance advocacy to help you receive a fair & equitable claim

- Estimate to compare to adjuster’s estimate

- Direct communication with your insurance company regarding payment (less work for you!)

- Filing of supplements on your behalf (if necessary).

- General liability insurance

- References/testimonials

- The highest-quality roofing system

- 2 year leak-free workmanship warranty